Three years ago, I was working with a client who sold enterprise software to manufacturing companies. Their sales team was talented, but they were struggling with the same problem that plagues most B2B organizations: finding prospects who were actually ready to buy. They were spending 80% of their time on outreach that led nowhere, chasing companies that weren’t even aware they had the problems my client solved.

Their cold email response rate was a dismal 2.3%, and their sales cycle averaged 14 months because they kept engaging prospects who were nowhere near ready to make a purchase decision. The sales team was demoralized, quotas were missed consistently, and the CEO was questioning whether their solution was viable in the current market.

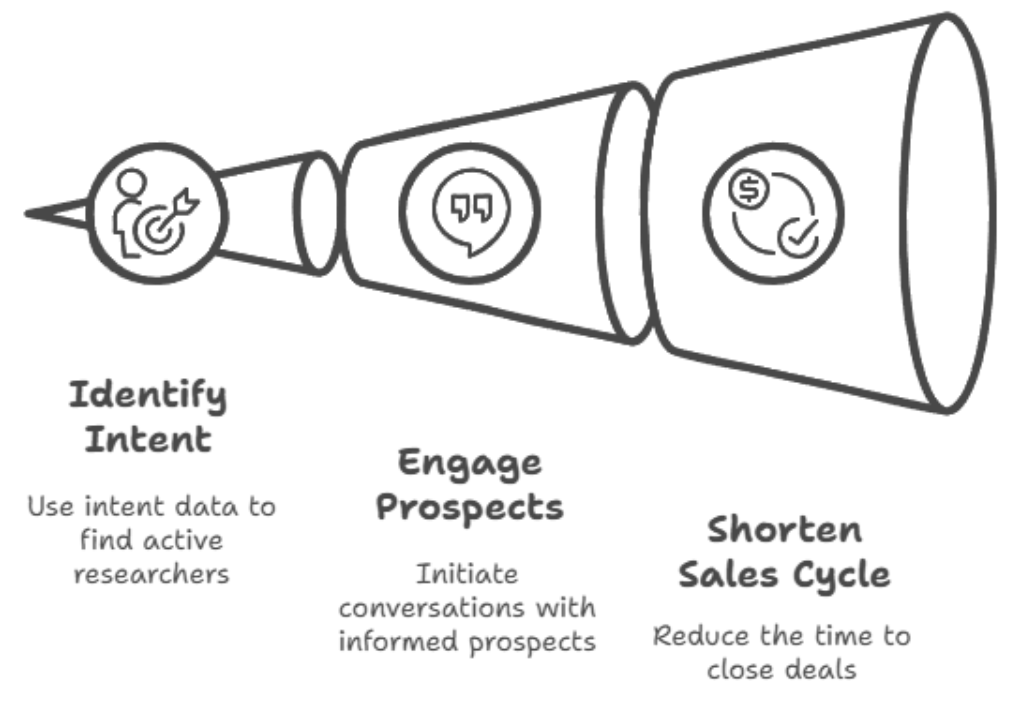

That’s when we implemented an intent data strategy that completely transformed their approach. Instead of blindly reaching out to companies that fit their ideal customer profile, we started identifying companies that were actively researching solutions in their category. We found prospects reading whitepapers about manufacturers automation, downloading guides about operational efficiency, and participating in online forums discussing the exact challenges my client specialized in solving.

The results were immediate and dramatic. Within 60 days, their email response rate jumped to 47%, and more importantly, the quality of conversations improved dramatically. Sales reps were talking to prospects who already understood their problems and were actively evaluating solutions. The sales cycle shortened from 14 months to 8 months because they were engaging buyers who were much further along in their research process.

But here’s what really opened my eyes: the biggest transformation wasn’t just the numbers. It was watching sales reps go from dreading their prospecting calls to being excited about their outreach. When you know a prospect has been researching solutions like yours for months, when you can reference specific content they’ve consumed and pain points they’re actively trying to solve, sales conversations become consultative rather than confrontational.

That experience taught me that intent data isn’t just about finding more prospects – it’s about finding the right prospects at the right time with the right message. And most sales teams who try intent data fail because they don’t understand this critical distinction.

Understanding Intent Data: Beyond the Buzzwords

Intent data reveals when potential buyers are actively researching solutions, but too many sales teams treat it like a magic lead generation machine. The reality is more nuanced and, when understood properly, much more powerful.

At its core, intent data is behavioral information that indicates where a prospect is in their buying journey. When someone downloads multiple whitepapers about cybersecurity solutions, spends significant time on vendor comparison sites, or participates in online discussions about security challenges, these actions signal intent to purchase in that category.

First-party intent data comes from your own digital properties – website visits, content downloads, email engagement, and product trial activity. This data is highly accurate because you own the source, but it only captures people who already know about your company. A prospect who spends 20 minutes reading your product documentation and returns to your pricing page multiple times is showing strong intent, but they’re already in your orbit.

Third-party intent data captures research behavior across the broader internet – industry publications, review sites, forums, and other vendors’ websites. This data is incredibly powerful because it reveals prospects who are actively researching solutions but haven’t discovered your company yet. Someone reading multiple articles about supply chain management software on industry websites is showing intent, even if they’ve never visited your website.

The key insight that most teams miss is that intent data tells you about timing and context, not just interest. A company might be a perfect fit for your solution, but if they’re not currently experiencing the pain points you solve, your outreach will fall flat. Intent data helps you identify the window when prospects are actually ready to engage with vendors.

Reading Intent Signals: What Actually Matters

Not all intent signals are created equal, and learning to distinguish between casual research and serious buying intent is crucial for success. I’ve seen too many sales teams chase every signal without understanding what truly indicates a prospect worth pursuing.

Content consumption patterns reveal far more than individual downloads. A prospect who downloads a single whitepaper might just be doing casual research. But someone who downloads multiple pieces of content over several weeks, progresses from educational material to more specific vendor comparisons, and spends significant time engaging with technical documentation is showing serious buying intent.

Research intensity and frequency matter enormously. Someone who visits competitor websites once might just be curious. But a prospect who visits multiple vendor sites repeatedly over several months, compares features and pricing, and reads customer reviews is actively evaluating solutions and likely has budget and timeline considerations.

Behavioral progression is one of the strongest indicators I look for. Early-stage research typically involves educational content about problems and general solutions. Mid-stage research focuses on specific solution types and vendor comparisons. Late-stage research involves pricing, implementation details, and customer references. Prospects who progress through this sequence over time are much more likely to convert than those who jump randomly between topics.

Organizational signals can be even more telling than individual behavior. When multiple people from the same company are researching solutions simultaneously, that often indicates an internal initiative or project that could lead to a purchase. I once identified a prospect company where the IT director, operations manager, and CFO were all consuming content related to manufacturing software within the same month. That organizational alignment suggested serious buying intent, and it became one of our largest deals that year.

Geographic and timing patterns also matter. Companies that suddenly increase their research activity around budget planning seasons, after leadership changes, or following industry events are often responding to specific business triggers that create buying opportunities. Understanding these contextual factors helps you time your outreach for maximum impact.

The mistake I see most often is treating all intent signals equally. A company downloading a general industry report generates the same alert as someone spending an hour on your competitors’ pricing pages. But these signals indicate completely different levels of buying intent and should trigger different sales approaches.

Building an Intent-Driven Prospecting System

Successful intent data implementation requires more than just subscribing to a data service – you need a systematic approach to identifying, prioritizing, and engaging prospects based on their behavioral signals.

Lead scoring needs to evolve beyond traditional demographic criteria to incorporate intent signals. I recommend creating composite scores that combine firmographic data (company size, industry, location) with behavioral data (content consumption, research frequency, topic progression). A small company with strong intent signals often converts better than a large company with weak signals.

Alert systems should be configured to notify sales reps when prospects exhibit specific behaviors or reach certain intent thresholds. But these alerts need to be meaningful, not overwhelming. I typically set up three alert levels: high-priority alerts for prospects showing strong buying intent, medium-priority alerts for prospects entering active research phases, and low-priority alerts for prospects showing initial interest.

Workflow integration is critical because intent data is most valuable when it’s seamlessly incorporated into existing sales processes. Your CRM should automatically populate intent scores and recent behavioral history so sales reps can reference this information during outreach. Marketing automation platforms should trigger personalized campaigns based on intent signals, ensuring prospects receive relevant content at the right time.

Territory assignment can be optimized using intent data to ensure prospects are assigned to reps who can respond quickly when buying signals emerge. I’ve seen companies restructure their sales territories based on intent data patterns, assigning high-intent prospects to their most experienced reps regardless of traditional geographic boundaries.

Crafting Messages That Connect

Intent data’s real power emerges when you use behavioral insights to craft outreach that feels relevant and timely rather than generic and pushy. The difference between successful and unsuccessful intent-driven outreach often comes down to how well you connect the prospect’s research behavior to your value proposition.

Reference specific research topics without being creepy about it. Instead of saying “I noticed you downloaded our whitepaper,” you might say “Given the current focus on supply chain resilience in manufacturing, I thought you’d be interested in how companies like yours are addressing these challenges.” This acknowledges their interest area without revealing that you’re tracking their behavior.

Address the progression of their research journey. Early-stage prospects need educational content that helps them understand their problems better. Mid-stage prospects want to see how solutions work and compare different approaches. Late-stage prospects need specific implementation details, ROI calculations, and customer references. Matching your message to their stage dramatically improves response rates.

Use intent insights to personalize content offers. Instead of sending generic company brochures, offer content that directly relates to their research topics. If they’ve been reading about cybersecurity compliance, offer a compliance checklist or framework specific to their industry. If they’ve been researching vendor selection criteria, provide a detailed comparison guide or evaluation rubric.

Time your outreach based on research patterns. Prospects who have been researching solutions for several months are often more receptive to vendor conversations than those just starting their research. Look for peaks in research activity or changes in research focus that might indicate movement toward a purchasing decision.

I’ve found that the most effective intent-driven messages feel like helpful resources rather than sales pitches. You’re responding to problems they’re actively trying to solve with information that advances their research process. This consultative approach builds trust and positions you as a valuable resource rather than just another vendor trying to sell them something.

Choosing the Right Intent Data Provider

The intent data market has exploded over the past few years, with dozens of providers offering different approaches, data sources, and coverage areas. Selecting the right provider can make the difference between transformational results and expensive disappointment.

Data source transparency is crucial because the quality and relevance of intent signals depends entirely on where they’re collected. Some providers focus on specific industries or publication networks, while others cast a broader net across the entire internet. Understanding their data sources helps you evaluate whether they’ll capture the research behavior of your target prospects.

Coverage depth varies significantly between providers. Some excel at capturing intent signals from large enterprises but miss small and medium businesses. Others have comprehensive coverage in certain industries but limited visibility in others. Make sure the provider’s coverage aligns with your target market characteristics.

Signal freshness affects how quickly you can respond to buying intent. Some providers update their data daily, while others have weekly or monthly refresh cycles. Given that prospect research patterns can change quickly, fresher data generally provides better results, especially for competitive markets where timing matters.

Integration capabilities determine how easily intent data can be incorporated into your existing sales and marketing technology stack. The best providers offer native integrations with popular CRM and marketing automation platforms, as well as robust APIs for custom integrations.

I always recommend testing multiple providers with small pilot programs before making large commitments. Most reputable providers offer trial periods or sample data sets that allow you to evaluate data quality and relevance for your specific use case.

Common Mistakes That Kill Results

After helping dozens of companies implement intent data strategies, I’ve identified patterns in what goes wrong when results don’t meet expectations. Most failures aren’t due to bad data – they’re due to poor execution and unrealistic expectations.

Overreliance on automation is one of the biggest mistakes I see. Companies implement intent data platforms and expect them to automatically generate qualified leads without human interpretation and follow-up. Intent data reveals opportunities, but sales reps still need to research prospects, craft personalized messages, and have meaningful conversations.

Treating all intent signals equally leads to wasted effort on low-quality prospects. A company that downloads one piece of content shouldn’t receive the same sales attention as a company showing sustained research activity across multiple topics. Developing scoring systems that prioritize prospects based on signal strength and progression is essential.

Ignoring false positives can damage your reputation and waste significant time. Students researching topics for academic projects, competitors gathering intelligence, and consultants staying current with industry trends all generate intent signals that look legitimate but don’t represent buying opportunities. Qualifying prospects beyond their intent signals is crucial.

Poor timing destroys even the best intent-driven outreach. Reaching out immediately after someone downloads content can feel pushy and obvious. Waiting too long means competitors might get there first. Finding the right timing requires understanding your prospects’ typical research and decision-making timelines.

Lack of personalization defeats the purpose of intent data. If you’re using behavioral insights to identify prospects but still sending generic outreach messages, you’re missing the main advantage of intent-driven prospecting. The message should reflect their specific research interests and buying stage.

The Future of Intent-Driven Selling

Intent data capabilities are advancing rapidly, driven by improvements in artificial intelligence, data collection methods, and integration technologies. These advances are making intent-driven selling more sophisticated and accessible for companies of all sizes.

AI-powered intent scoring is becoming more accurate at predicting which prospects are most likely to convert. Machine learning algorithms can analyze thousands of behavioral patterns to identify subtle signals that human analysts might miss. These systems continuously improve as they process more data and learn from conversion outcomes.

Real-time intent tracking is emerging as providers develop capabilities to capture and deliver intent signals with minimal delays. This enables more timely outreach and better coordination between marketing and sales teams when prospects show buying signals.

Cross-channel intent orchestration is becoming possible as data providers expand their coverage across different digital channels and offline events. Understanding prospect research behavior across websites, social media, events, and other touchpoints provides a more complete picture of buying intent.

Predictive intent modeling uses historical data to forecast when prospects are likely to enter buying cycles based on business triggers, seasonal patterns, and other factors. This proactive approach enables outreach before prospects become actively engaged with competitors.

Making Intent Data Work for Your Team

The manufacturing software company I mentioned at the beginning didn’t just implement intent data – they fundamentally changed how they think about prospecting. Instead of trying to create demand among uninterested prospects, they focused on finding prospects who were already experiencing the problems they solved and actively researching solutions.

This shift in mindset is crucial for intent data success. You’re not using behavioral insights to be more efficient at traditional prospecting – you’re using them to engage in fundamentally different conversations with prospects who are ready to have them.

The most successful intent data implementations I’ve seen share several characteristics: clear scoring criteria that prioritize prospects based on signal strength and progression, integrated workflows that make intent insights easily accessible to sales reps, personalized outreach that references prospects’ research interests without being invasive, and continuous optimization based on conversion data and sales feedback.

Intent data won’t solve all your prospecting challenges, but when implemented properly, it can dramatically improve the efficiency and effectiveness of your sales efforts. The key is understanding that intent data is about timing and context, not just contact information. Use it to find prospects who are ready to buy, engage them with relevant messages, and build relationships based on their actual needs rather than your sales quotas.